By Noah Yosif

It’s official — the U.S. economy is in full-swing recession. While formal confirmation by the National Bureau of Economic Research is always appreciated, the signs were pretty obvious: social distancing grinding business activity to a near halt, skyrocketing weekly unemployment claims at both a state and national level and, of course, market volatility erasing three years’ worth of gains in a matter of weeks.

In fact, the NBER estimates this recession first started in February, making this newly reported contraction four months old.

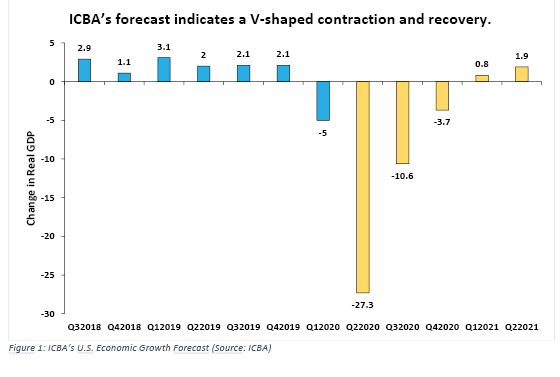

With irrefutable evidence that the United States is in a recession, zealous market watchers are now searching for clues as to its size and scope. At ICBA, we took the liberty of crunching the numbers in search of some answers and our conclusions point to a short, sharp and spotty recession.

Figure 1 shows our forecast for economic growth in the near term, indicating a V-shaped trajectory for recovery. While we expect the second quarter GDP to contract by a record margin at 27.3%, we also anticipate a quick recovery that will enable the U.S. economy to expand once again by 2021.

These patterns are much different from what we saw in 2008, and in many recent financial crises to date, but for a good reason. This recession, borne from the coronavirus pandemic, constituted an exogenous shock causing widespread financial disruption within every sector of the U.S. economy, as opposed to concentrated imbalances. As public health authorities continue to relax social distancing measures in the upcoming months, the U.S. economy is likely to rebound, with businesses and consumers once again free to operate with fewer restrictions.

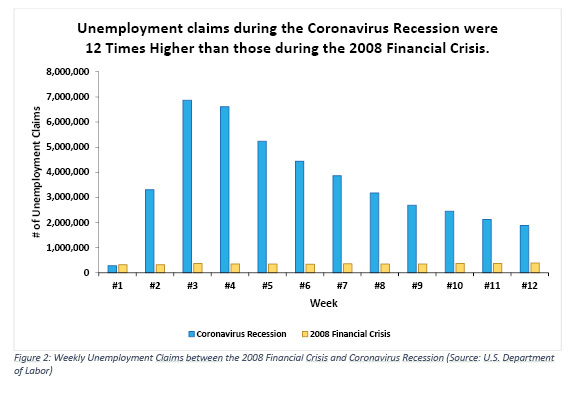

The unique causal dynamics of this recession provide much credence to our calculations indicating a short recession and quick recovery, but they also hint at the probability of a more severe contraction as well. Because social distancing measures have pressured revenues via decreased business activity, employment has become the primary concern and consequence of this pandemic as companies seek to shore up additional capital.

Figure 2 demonstrates the severity of this recession as weekly unemployment claims filed within the first three months were 12 times higher than during the 2008 financial crisis. Because the coronavirus recession has caused financial disruptions in every sector of the economy, we can expect more severe declines in household income and consumer spending, given its acute effect on employment.

The expected extent of this pain is still ambiguous, in keeping with this year’s theme of economic uncertainty, but will be unevenly distributed among localities, inducing a spotty recovery that varies between states and counties in timing, speed and effect. Two factors that will have an outsized influence on their recovery will be the ongoing public health threat posed by the coronavirus and localities’ financial position prior to the recession. Counties and states that had a healthy circulation of income between consumers and businesses prior to the recession will be well-positioned to weather a protracted crisis and recover at a quicker pace.

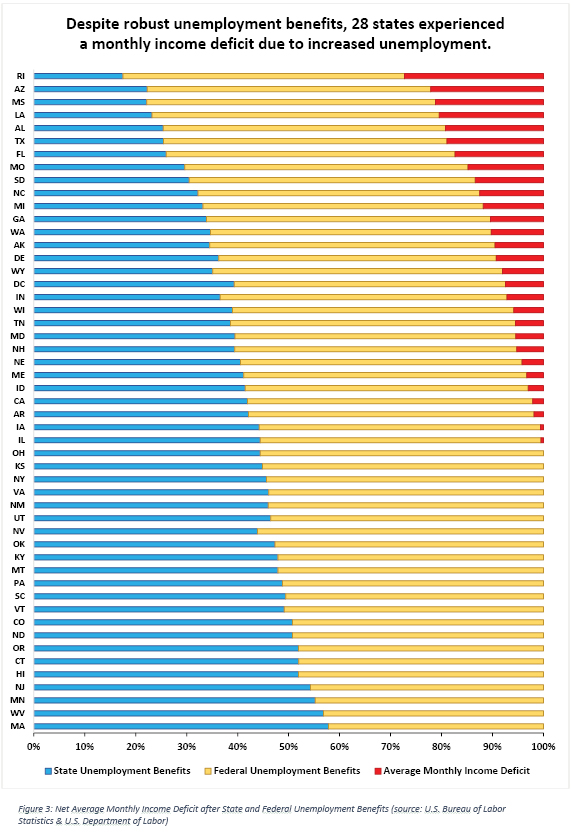

Figure 3 examines the average monthly income deficit by state, calculated as the average monthly wages lost from rising unemployment offset by state and federal unemployment benefits in April. Despite robust protections for unemployed workers, 28 states experienced an

income deficit, while extended unemployment provisions implemented by the CARES Act, which are set to expire by the end of next month, provided a vital lifeline to 34 states by enabling them to recoup more than 50% of the difference. Because each state is in a unique position concerning mitigation of the coronavirus pandemic and consequent economic injury, there will not be a synchronized national recovery, and certain states will need additional assistance to fully heal.

As the Coronavirus Recession reaches its four-month mark, we continue to receive more data that provides greater clarity to the good, bad and ugly of this contraction. On one hand, this recession will likely be much shorter than its predecessors, given its origins as an exogenous, noneconomic shock. But the financial pain inflicted on consumers and businesses will also set records in severity, while the path to economic recovery is akin to geographic roulette, making for a disjointed and spotty return to normalcy. Many unknowns remain concerning the United States’ eventual road to recovery, most of which depend on the ability of public health authorities to contain this outbreak via testing at a meaningful level until the development and distribution of a vaccine. In the meantime, we know that community banks continue to be a vital component to the recovery equation.

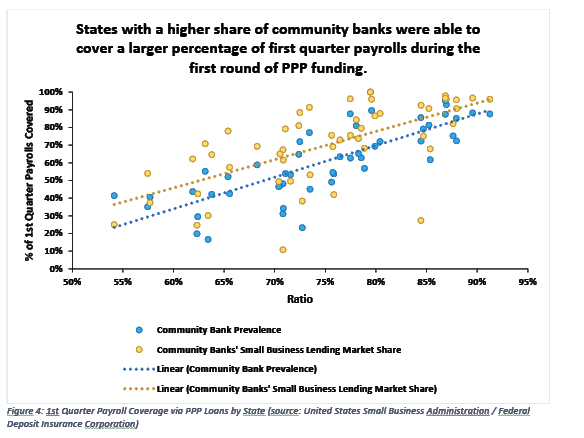

Community banks were the most prevalent conduit for small businesses seeking lifelines in operating capital via the Paycheck Protection Program, issuing nearly two-thirds of PPP funds, which were critical for mitigating further increases in unemployment and supplying households with much-needed income to whether declines in liquidity due to decreased business activity.

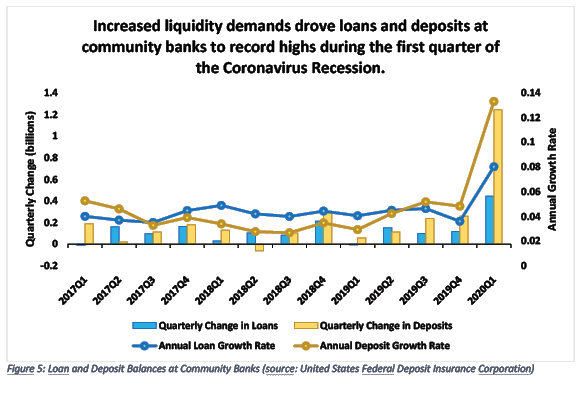

As Figure 4 shows, states with a higher share of community banks received more PPP funding during the early stages of the current recession, with the top 10 states able to cover 20% more of their payrolls than the bottom 10 states. In addition, by performing their most basic functions, from accepting deposits to providing loans, community banks have been vital pillars of support to Main Street by facilitating a healthy circulation of capital to keep local economies in operation while social distancing measures have gone into effect. As shown in Figure 5, community banks posted major gains in deposits and loans during the first three months of this recession.

Upon closer examination of the data, it is clear that this current recession poses both significant economic threats, and concurrent opportunities, from which to make the most of an inevitable economic phenomenon and to rebound on stronger footing and shoulder another decade’s worth of expansion. In particular, the dynamics of this recession present major opportunities for community banks to facilitate a speedy recovery and mitigate its potential severity while serving as an important resource for localities at different stages of the healing process.

While the current economic landscape may appear bleak at first sight, the data presents a strong case for cautious optimism as we press forward in these uncertain times in hopes of a brighter tomorrow.

Noah Yosif

This story appears in Issue 2 2020 of the Community Banker Magazine.