The FASB’s new credit loss model is one of the most significant accounting changes in recent history. The time to act is now – here is how you can prepare and comply.

In June 2016, the Financial Accounting Standards Board (FASB) issued a new expected credit loss accounting standard, which introduced an updated method for estimating allowances for credit losses. The Current Expected Credit Losses methodology (CECL) applies to all banks, savings associations, credit unions and holding companies.

If your institution has not yet adopted CECL, now is the time to refresh yourself on the fundamental changes and – most importantly – to start planning.

What is CECL?

The impairment model introduced by the CECL standard is based on expected losses rather than incurred losses. With that, an entity recognizes its estimate of lifetime expected credit losses as an allowance. CECL also strives to reduce complexity by decreasing the amount of credit loss models available to account for debt instruments.

This change was under discussion for many years before its issuance, with the impacts of the global economic crisis highlighting the shortcomings of the Allowance for Loan and Lease Losses (ALLL) framework. FASB concluded that the ALLL approach delayed recognizing credit losses on loans and resulted in insufficient loan loss allowances.

“There are a lot of decisions that need to be made. By starting as early as you can, you avoid any roadblocks in getting CECL implemented by the deadline.” – Brian Lewis, RMSG Senior Risk Advisor

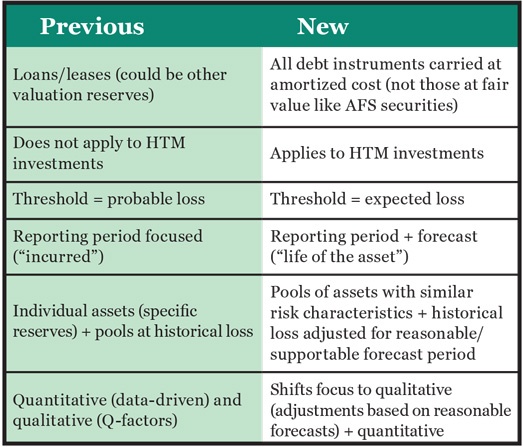

Differences between the previous and the new standards

How will CECL impact my institution?

Adopting the new standard will influence internal controls and information likely not previously integrated into financial reporting efforts. In other words, the scope of CECL is far-reaching—spanning corporate governance, modeling, credit analysis, technology and others. Additionally, CECL affects all entities holding loans, debt securities, trade receivables and off-balance-sheet credit exposures. In short, it will have significant implications for operations at most financial institutions.

How to proceed toward CECL transition

The time to get started – if you have not already – is now. This is a significant change with extensive effects and potential risks. Careful – and early – planning is critical. Here are nine key steps institutions can take to take to achieve CECL compliance:

- Identify functional areas (such as lending, credit review, audit, management, and board) that need to participate in the transition project/implementation and ensure those working in these areas are familiar with the new standard

- Determine your effective date and whether to adopt early

- Make a project plan and timeline

- Discuss the plan and progress with all stakeholders as well as your regulator

- Determine the ACL estimation method/methods that may be used

- Identify available data and any other data that may be needed

- Identify potential system changes

- Evaluate and plan for the potential impact on regulatory capital

- Have a straightforward, well-understood process

Finally, it’s necessary to take a holistic view to ensure a smooth transition, including:

- Built-in testing for data integrity and method estimation validation

- Update other bank policies and reports so they are consistent with processes

- Consider running parallel with the ALLL to evaluate risks

- Back-test as part of supporting modifications and improvements

What are the implementation timelines?

This standard was effective for many institutions by Dec. 2019, and all others will need to comply by March 2023. These dates are based on the Public Business Entity (PBE) status for institutions. Early adoption was allowed for any institution after Dec. 2018.

Contact us for a complimentary and confidential risk management consultation at 866.825.6793 or riskmsg.com.

RMSG is a wholly-owned subsidiary of Bankers Healthcare Group. To learn more about RMSG, visit riskmsg.com.